Freelancing guide

Posted on Dec 31, 2024

Subscribe to our newsletter

Get the latest updates, insights, and tips delivered straight to your inbox.

As a freelancer, there are multiple ways to receive international payments in India, such as via bank transfer, payment platforms, or foreign currency demand draft.

However, each payment method has its pros and cons. Choosing the right method is important otherwise you risk delayed payments or low conversion rates. In this artic

In this blog post, we will delve into how to receive international payments in India as a freelancer. We'll also outline key factors to consider, and point you toward the most efficient payment methods.

Different Ways to Receive International Payments in India

The following are some of the most common methods on how to receive international payments as a freelancer.

1. International wire transfers via SWIFT

International wire transfers involve a direct bank transfer from the sender’s foreign bank account to your local bank account in India. This is done through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system.

You have to provide the SWIFT code, bank name, account number, recipient’s name, and other relevant details to the sender. The payment is converted from foreign currency into INR. The process usually takes 3-5 business days.

Pros of international wire transfer:

Popular payment method trusted globally for B2B global payments

Highly secure for receiving large amounts of international payments

Direct transfer to your bank account

Cons of international wire transfer:

Payment processing can take up to 5 business days

Banks may charge high transaction fees, currency conversion fees, and intermediary charges

Requires a lot of documentation

2. Direct bank transfer via NOSTRO accounts

International wire transfers can be complex and require additional documentation. If you don't prefer the complex process, you can receive international payments through direct bank transfer. This works through NOSTRO accounts.

These are overseas bank accounts opened by Indian banks. The client can transfer the payment in USD or their local currency in the NOSTRO account. Your bank will then convert the foreign currency into INR.

Pros of NOSTRO accounts:

Secure payment system backed by banking infrastructure

Enable structured foreign payments

Works best for trade settlements and business contracts

Cons of NOSTRO accounts:

You might experience some interbank processing delays.

Understanding foreign currency exchange and banking procedures can be challenging.

Typically not suitable for freelancers or small businesses.

3. Virtual international accounts

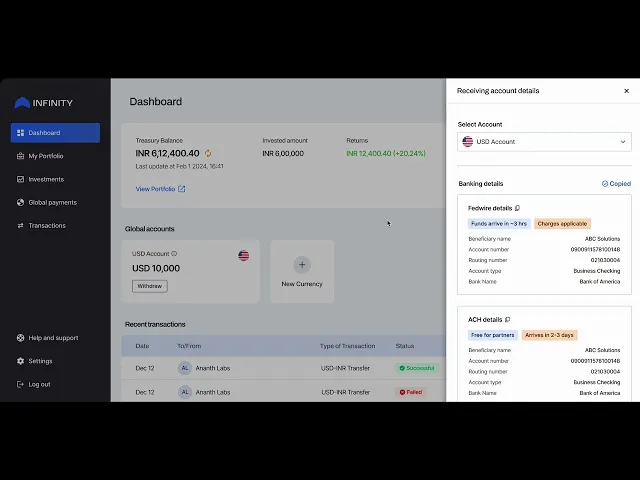

Virtual international accounts are offered by payment platforms like Infinity, Wise, and Skydo. As the name suggests, a virtual bank account is created in a foreign country, and your clients can transfer payments to those bank accounts through local transfer.

The payment is then sent to the Indian bank account of these payment platforms and converted to INR. This reduces conversion and transaction fees. Virtual bank accounts are ideal for freelancers and small businesses.

Pros of virtual international accounts:

Payment settlements are usually done within 1–2 business days

Lower fees and mid-market exchange rates

These platforms are easy to use

Cons of virtual international accounts:

Requires platform setup and KYC

It may not be suitable for very large transactions or government contracts

Withdrawal limits and fees vary as per the provider

Selecting the Right Method for International Payments

Before making a decision, consider the following factors:

Speed: How long do you need to wait for the payment? If you have to receive a large amount and can wait for up to 5 business days, go with wire transfers. For quick payments, international payment platforms like Infinity work best.

Fees: What costs are involved, and how will they affect your earnings? SWIFT transfers often have high transaction fees and hidden charges. However, payment platforms with virtual bank accounts mostly offer a flat transaction fee.

Compliance: Is the method compliant with Indian regulations? Check that the payment platform complies with international payment and GST compliance. Look for platforms that offer automated FIRC generation.

Transparency: Bank transfers can be difficult to track. If you want higher transparency, go with platforms that offer real-time payment tracking features.

Things to Know Before Receiving International Payments in India

International payments differ from domestic transfers. When handling international payments in India, there are a few things to note:

Timelines

International payments are usually slower than domestic transfers. For a country like India, accustomed to fast transfers via UPI or RTGS, this can take anywhere between 1 and 7 working days, depending on the means of transfer. Even as an example, the SWIFT bank transfer might take 5 working days, but that is where platforms such as PayPal would be able to process payment faster.

Compliance

India is heavily governed regarding international transactions to deal with money laundering and terror financing. Some of the compliance-related aspects you have to be aware of includes;

Purpose Codes

There is the alphanumeric purpose code attached to each international transaction for defining the rationale for transferring. For example, when one receives service-rendering payments, an appropriate purpose code must be quoted. Lack of such would either lead to delays in or rejection of the payment.

Example

If you are a freelancer based in India and working with a client in the UK, and you receive a payment for freelance services, you have to mention the correct purpose code that matches the nature of the transaction. A common code for freelance work is "SPL" (services rendered).

FIRA (Foreign Inward Remittance Advice)

FIRA is a bank-issued document evidencing the fact that an international payment has been received by the bank. It can be important for tax reporting and compliance purposes. Freelancers and exporters must retain their FIRAs as proof of foreign earnings.

In case you receive a payment from a client abroad, you can request the FIRA document issued by your bank. This will help you comply with tax regulations and serve as evidence of income when filing taxes.

BRC (Bank Realisation Certificate)

BRC is a certificate that proves that the money you received is matched by the goods or services that you exported. It is more relevant to exporters but freelancers and businesses belonging to certain categories may require it as well. Freelancers generally don't require BRC unless they fall under the export of software or services.

Tax Implications

Tax implications need to be understood when you are receiving international payments. Here's a quick overview:

GST

Exports are considered zero-rated under GST for cross-border payments, which means there is no GST applicable over the goods or services being exported out of India. But in case GST gets wrongly deducted, you can always get it refunded with a copy of your FIRA document.

Income Tax

Though earnings through exports are exempt under GST, income tax levies still apply. For Indian income tax slabs, foreign income is subject to taxation in India. Ensure you declare all such international earnings accurately.

Illustration:

If you’re a freelancer earning USD 5,000 from a US client, you need to report this amount in your income tax filing. While there’s no GST on this income, you’ll need to pay tax based on your applicable tax slab.

Charges

Understanding the fees associated with receiving international payments is critical to managing your business’s finances effectively. These charges include:

Bank fees: Banks charge SWIFT fees, forex markups, and other service charges. These can quickly add up, reducing your payout.

Payment gateway fees: Services like PayPal charge transaction fees, currency conversion fees, and fixed fees depending on the country and transaction type.

You need to evaluate the charges before choosing a payment method since the fees can really impact your earnings.

Comparison of Payment Methods

Let's get into a detailed comparison of the most common payment methods available for receiving international payments in India.

1. Banks

Pros: Safe and compliant with Indian regulations.

Cons: Slow processing times (up to 5 business days or more), high fees like SWIFT charges, forex markups, and additional service charges.

2. Virtual International Bank Accounts (Wise, Payoneer, and others)

Pros: Faster settlement times, no SWIFT fees, live exchange rates, simple compliance (with automatic FIRA generation).

Cons: Fees vary by platform, but generally lower than traditional banks. Some services might charge for issuing FIRA.

Choosing the Best Option for Your Business

The best payment method depends on your specific needs. Here’s a quick breakdown to help you decide:

Banks: Best for export houses and large businesses; it caters to companies that handle large volumes, thus demanding the highest extent of compliance.

Virtual Bank Account: Suitable for freelancers as well as small-to-medium companies that seek a cost-efficient, quick, and streamlined payment process.

Infinity Offers Easy International Payment Solution

Infinity is a simple solution for businesses and freelancing in India, which don't need to face an issue in receiving international payment transactions.

Quick Setup: Set up an international account in minutes, so you can start receiving payments from across the globe without delays.

No Hidden Fees: Enjoy live forex rates with no markup and transparent charges.

Compliance Made Easy: Get automatic FIRA downloads for every transaction, ensuring that you stay compliant with Indian regulations.

Dedicated Support: Infinity's customer support is also there to guide you step by step in the entire process so that your pay journey is smooth.

It is the best solution for a person who wants to avoid fees and streamline the payment process.

Conclusion

International payments to India do not have to be complicated. Choosing the right method, understanding compliance, and comparing the costs involved will allow you to make smoother and more profitable transactions. Whether freelancer or growing business, you must be aware of all factors—the timing, compliance, and fees—before choosing the best payment solution for your needs.

FAQs on Receiving International Payments as a Freelancer

1. How can freelancers in India receive international payments?

You can receive payments via international wire transfers, NOSTRO accounts, or virtual accounts. Check the transaction charges before selecting the payment method.

2. Do I need a business account to receive international payments?

No, you can receive international payments in India in your personal savings account. However, it is better to create a business account for higher volumes and tax compliance.

3. Do I need to pay tax on international freelance payments?

Yes, you need to pay income tax on international freelance payments. They must be reported under Income from Business/Profession head.

4. What documents are needed to receive international payments?

You need a PAN card, bank account, and sometimes an FIRC (Foreign Inward Remittance Certificate) for compliance with international payments.