Discover infinity

Posted on Jan 16, 2026

Subscribe to our newsletter

Get the latest updates, insights, and tips delivered straight to your inbox.

Talk to our expert today

Wise (formerly TransferWise) has become a go-to option for cross-border payments because it’s simple to use and the product experience feels pretty smooth, whether you’re an individual or a business.

But “easy” doesn’t always mean “best value.”

When you’re getting paid from overseas, don’t just look at the advertised fee; check the full cost breakdown, like transfer charges, exchange rate margins, and little add-ons that quietly eat into the amount that hits your bank.

In this guide, we’ll explain how Wise works and then compare it with a few alternatives, so you can pick what fits your routine, costs you the least, and gets you paid the way you prefer.

What is Wise (Formerly TransferWise India)?

Wise handles international transfers for both individuals (P2P) and businesses (B2B).

It began as a peer-to-peer service that made it easier for people to send money across borders without going through traditional routes like banks or card networks.

As it grew, Wise added more features and built out a full set of tools for business payments, too.

Wise typically uses the mid-market exchange rate (the rate you’ll see on Google) rather than adding its own FX markup.

Instead, wise earns through a separate conversion fee, which varies by corridor.

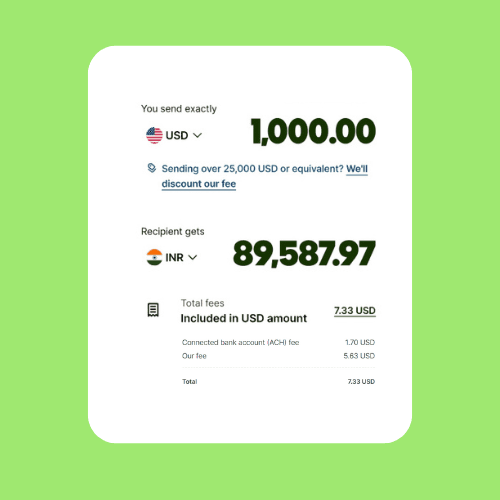

Wise India 2026: Charges you need to know

Here’s a quick breakdown of Wise fees for receiving money from abroad as an Indian business:

The forex rate is the mid-market rate with no markup.

There is no registration fee for receiving international payments.

The conversion fee varies by currency and amount, but for major currencies it typically comes to around 1.6%–1.7% of the total transfer value.

The eFIRC fee varies by currency, and for USD it is $2.50.

Source: Wise India

What are the Features of Wise India?

Here’s a clearer way to say it:

Now, let’s look at Wise’s key features.

1)Person to Person transfers (P2P)

Wise’s person-to-person (P2P) option lets you send or receive money internationally from friends, family, or even clients abroad. The person receiving the payment doesn’t need a Wise account; funds can be sent straight to their bank account.

The main advantages of Wise’s P2P transfers are:

Transparent transfer fee for P2P transfer

Mid-market exchange rate

No hidden FX markups, so you can see the cost upfront

Wise P2P transfers are usually quick and usually arrive within 24 hours or one business day.

Still, in India, Wise’s P2P(Person to Person) option isn’t ideal for business receipts because it usually doesn’t come with a Foreign Inward Remittance Advice called FIRA, so when you need official inward remittance proof, compliance and accounting can get messy.

2)Business to Business transfer (B2B)

Wise also provides a full business (B2B) setup with multi-currency accounts, letting companies hold and manage 40+ currencies.

For Indian businesses receiving money via Wise account details, funds are automatically converted to INR and sent to your verified Indian bank account (you can’t hold balances in those account details).

It’s especially handy if you work with international clients, because it helps you collect payments in different currencies in a way that feels “local” to the payer.

Wise India provides businesses with local bank details in multiple currencies, including EUR, GBP, USD, AUD, CAD, NZD, SGD, and HUF.

So that you can accept payments as if you’re local, without needing to open and maintain separate bank accounts in each country.

It also includes batch payments, which let you pay multiple recipients in one go instead of sending transfers one by one.

Wise also provides API integrations for businesses that want to connect payments directly to their systems.

This makes it possible to automate workflows such as payouts, reconciliations and routine transfers, therefore your team spends less time manually managing international transactions.

3)Multi-currency virtual accounts

Wise’s multi-currency account lets individuals and businesses hold, manage, and convert money across multiple currencies when making international payments.

Because multiple currencies sit in one place, you don’t need separate bank accounts in different countries. With a single Wise account, you can manage 40+ currencies under one profile (INR isn’t supported for holding).

4)Debit Card facility

The Wise card is great for travel and international online purchases, but the standard Wise Debit Card is still unavailable to users in India.

Instead, Wise has rolled out the Wise Travel Card, with the ₹460 issuance fee waived until 10 Feb 2026, and it’s meant only for international spending, not for INR payments within India.

Source: Wise India

5)Digital FIRA

For compliance needs, Wise can provide a digital Foreign Inward Remittance Advice (FIRA) for each incoming international payment received via the Wise Business account in India

However, this comes with a charge, and the fee depends on the currency for USD receipts; it’s typically $2 per FIRA.

Is Wise transfer allowed in India?

Yes, Wise transfers are permitted in India. Wise is a regulated provider authorized by the Reserve Bank of India (RBI).

That said, there are a few rules and conditions, especially around sending and receiving INR, that you should be aware of. You can read the relevant guidelines here.

Wise India: Better Alternatives to Consider

If you’re exploring Wise alternatives for receiving international payments in India, some of the most commonly used options include Infinity, PayPal and Payoneer.

The rule is simple: look at the INR that lands in your bank and the paperwork you’ll need to close.

PayPal and Payoneer can get the job done, but the amount you receive can change depending on how fees and currency conversion are applied, which makes payouts harder to predict.

For most Indian freelancers, startups, and small businesses, Infinity is the strongest choice when you want everything to be seamless.

Infinity charges a flat 0.5% fee, offers live exchange rates with zero markup, and makes it easy for international clients to pay you like they would any local business.

Every payment comes with an instant Foreign Inward Remittance Advice (FIRA), so accounting, reporting, and compliance stay straightforward.

It’s worth weighing the options and choosing the one that best aligns with your needs and business priorities.

See how seamless global payments can be with Infinity. Sign up today and find out!

FAQs on Wise India 2026

Does TransferWise work in India?

Yes, Wise (formerly TransferWise) works in India but with some limitations.

Is the Wise debit card available for Indian residents?

Wise debit card is currently not available for Indian residents.

Which is the best Wise alternative for receiving international payments in India?

Infinity is a great Wise alternative for Indian freelancers and businesses.

It offers a flat 0.5% fee, live FX with no markup, free instant FIRA, and dedicated customer support.

Can I use the Wise Travel Card in India for domestic INR payments?

No. Wise Travel Card can’t be used in India (it’s for use when travelling abroad)

Is there any fee for Wise Travel?

No. Wise has waived the ₹460 issuance fee for sign-ups before 10 Feb 2026.