Global payments

Posted on Jan 8, 2026

Subscribe to our newsletter

Get the latest updates, insights, and tips delivered straight to your inbox.

If you’re an Indian freelancer, SMB/SaaS founder, exporter, or agency getting paid by overseas clients, chances are you’ve received money through a SWIFT wire.

SWIFT is still the most common route banks use for international transfers.

But for many businesses in India, it comes with the headache of slow settlement, high bank charges, and deductions that are discovered only after the money is deposited in your account.

What should have been a straightforward payment is becoming a process due to delays from the intermediary bank, ambiguous deadlines, and the additional work required to obtain compliance documents.

The good news is you now have better options.

Newer payment rails are faster, clearer on fees, and easier to manage, especially for Indian freelancers, startups, exporters, and small businesses.

In this guide, we’ll quickly cover what SWIFT is, why Indian businesses are moving away from it, and the best SWIFT alternatives you can use today, as well as why Infinity is built for Indian freelancers, founders, agencies, and exporters getting paid from abroad.

What is SWIFT (Society for Worldwide Interbank Financial Telecommunication)?

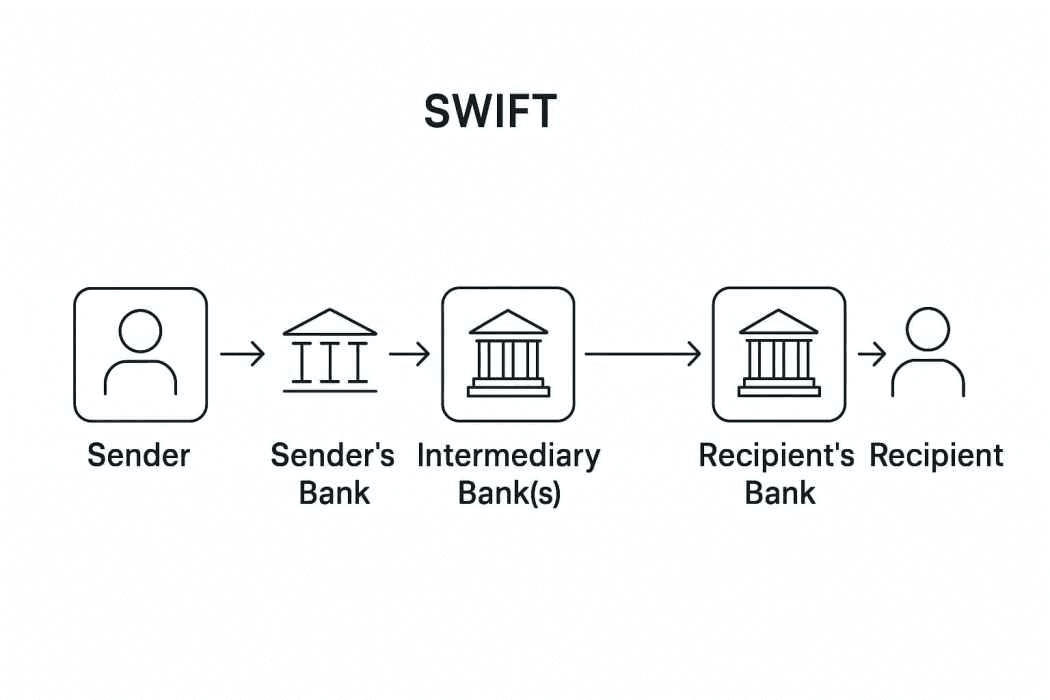

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. SWIFT is a global network that banks use to exchange payment messages securely.

Its function is to give banks instructions on where the money should go; it does not store or transfer money itself.

Due to its widespread compatibility and ability to handle high-value payments, it continues to be the standard for many international bank transfers.

But it still falls short of what modern businesses want the most, that is, faster settlement and transparent, trackable fees, because it relies on multiple intermediary banks and multi-layered procedures.

Why consider alternatives beyond SWIFT transfer?

When you rely on SWIFT for international transfers, a few common pain points tend to show up:

Multiple fees: Banks deduct various fees, including processing fees and currency conversion charges. This can reduce the total amount you will receive.

Slow processing: Usually, it can take 3–7 days for the beneficiary to actually receive the money, but holidays/intermediary banks can delay it further. Errors in bank account details, public holidays, or involvement of intermediary banks can further slow down the payment process.

Complexity: Different countries have different banking regulations and requirements.

Currency fluctuations: Exchange rates can shift between when you send the payment and when it settles, so the final amount you receive may change.

Limited Customer Support: Traditional banks may offer limited customer support for international issues, and it’s also hard to track delays or missing transfers.

Expensive: Cross-border payments pass through different systems and rules in each country, making the process complicated.

So even if your client sends the full amount, you might still receive less, and later than expected. Here’s how SWIFT pain points usually show up in real life:

SWIFT pain point | How it hits you |

Upfront bank charges | You may pay $20–$50 per transfer just to receive the money |

Unexpected intermediary deductions | Banks in between can shave off another $10–$30 without warning |

Poor exchange rates | FX markups can mean getting 2–4% less than the live rate |

Slow credit timelines | Funds often take 3–5 working days to show up |

Paperwork hassle | FIRC/eBRC often involves manual follow-ups and coordination with the bank |

The SWIFT network is best for large-value business transactions with international clients who prefer SWIFT bank-to-bank transfer.

Top 5 SWIFT alternatives to consider in 2026

1. Infinity

If your goal is to get paid by an overseas client and receive the money in India, Infinity is a great SWIFT alternative.

Infinity is designed with one clear objective: to help Indian freelancers, startups, agencies, and exporters receive international payments faster with minimal deductions.

Here’s what you get:

Fee: ~0.5% flat per incoming payment

FX: live market rate, no hidden markup

FIRA: auto-generated for every successful transaction

Settlement: 24-hour settlement to your Indian bank account

On the product side, Infinity is also designed to be easy to use: share payment links with clients, track payments in the dashboard, and use multi-currency options, with no complicated setups.

If you’re a freelancer, small business owner, or exporter, you probably want to avoid large cuts and keep more of what you earn.

Infinity’s transparent market exchange rates, flat fees, and compliance support make it a suitable choice in India.

Know how much you will receive in INR with Infinity's currency converter.

2. Wise Business

Wise Business is a great SWIFT alternative if your main priorities are transparent exchange rates and clearly displayed fees.

As it uses the mid-market rate, preventing you from being hit by an inflated FX rate, it is popular mainly among sole proprietors/freelancers in India (limited entity support)

However, Wise has certain practical limitations for Indian users that become important when your invoices increase or you require additional documentation

Here’s what you get:

FX fees: typically ~1.6%–1.8% (shown upfront, no hidden markup)

FIRA: ~$2.5 per transaction (paid, not free)

Invoice limit: up to $10,000 per invoice for Indian users

Therefore, Wise is most effective for small businesses and non-price-conscious freelancers who want straightforward transfers and transparent foreign exchange rates, and who don't require compliance support and much invoice flexibility.

Read more: Top Wise alternatives in India 2026

3. Stripe India

If you’re a SaaS founder or building a product with in-app checkout, subscriptions, or a marketplace, Stripe is often the default choice.

It’s built for businesses that want a flexible payments stack and the ability to customise everything, from billing to payouts.

But as a SWIFT alternative for receiving international payments into India, Stripe can feel less practical because access and pricing in India aren’t as straightforward.

Here’s what you get:

International card payments: ~4.3% per transaction

Currency conversion: additional ~2% on top

FIRA: generally not provided in India

Access: often invite/approval-based for Indian businesses

Stripe’s biggest strength is its flexibility, including subscriptions, custom checkouts, marketplace payouts, and integrations.

In India, the trade-offs are high fees (4.3% + 2% FX), onboarding based on approval, and no FIRA, so it’s not ideal if you want low-cost payouts with compliance documents.

Read more: A complete guide to Stripe India

4. PingPong

If you sell on global marketplaces like Walmart, Amazon, Etsy, or eBay, PingPong is built for that world.

It’s designed for marketplace payouts and can be a practical alternative to SWIFT if your payments are coming through those platforms.

But like most payout providers, the real decision comes down to FX and fees.

Here’s what you get:

Fee: ~1% of the amount received

FIRA: free digital FIRA included

FX transparency: exchange rate isn’t always displayed upfront (may include a markup)

PingPong is a strong fit for e-commerce and marketplace sellers, especially when you’re dealing with VAT/GST and compliance-heavy regions.

The main watch out is FX, since the exchange rate isn’t always shown clearly upfront, the final INR you receive can vary.

5. PayPal

If your client wants to pay using a card or already uses PayPal, this is often the quickest way to get money moving.

But as a SWIFT alternative, PayPal’s tradeoff is simple: convenience comes at a cost.

Here’s what you get :

Receiving fee: 4.4% + fixed fee (varies by currency)

FX conversion: PayPal’s rate includes an extra ~3%–4% above the base exchange rate.

Settlement: funds are auto-transferred to your Indian bank, and can take up to 5 business days to reflect.

FIRA: available as a monthly digital FIRA (downloadable by the 15th of the next month).

The primary benefit of PayPal for your client is its familiarity, global reach and ease of use.

The drawback is that your take-home pay is significantly lower than you would anticipate after fees and the exchange rate margin are deducted.

Read more: PayPal India

Why Businesses Are Moving from SWIFT to Infinity in 2026

Features | Infinity | SWIFT |

Exchange Rate | Live market rate (no markup) | Markup of 2–4% over mid-market |

FIRA availability | Free and auto-generated per transaction | Often needs manual follow-up and |

Fee Structure | 0.5% flat, transparent | Multiple charges (SWIFT fee, FX margin, receiving/intermediary fees) |

Time to Receive Funds | Typically ~24 hours | Typically 3–5 working days |

Intermediary Bank Charges | None | May include $10–30 per transfer |

Ease of Use | Digital onboarding and dashboard/payment links | Paperwork, branch dependency, manual processing |

How to Receive International Payments with Infinity (3 Steps)

Sign up and get your multi-currency account details

Once you sign up with Infinity, you have to complete a small KYC process that hardly takes 5 minutes, after which you have a multi-currency account available to you. You can share the details of the Infinity’s multi-currency account without the usual SWIFT back-and-forth.Get paid by your client like any normal business payment

Your client sends funds like they are making some domestic payment (no confusing SWIFT tracking or surprise intermediary deductions).Receive INR in your Indian bank account

With live exchange rates without any FX markup and FIRA automatically generated, your money usually arrives in your bank account within a day.

If you're still receiving payments from overseas via SWIFT, you're likely facing the same three problems: higher costs, longer turnaround times, and unnecessary administrative work.

Infinity's integrated documentation and transparent exchange rates are intended to remove that friction, enabling you to maintain compliance, get paid faster, and keep a larger portion of your earnings.

Are you sick of paperwork, payment delays, and covert cuts?

Sign up today with Infinity receive international payments seamlessly!

FAQs on SWIFT Alternative 2026

What is the best SWIFT alternative in India for receiving international payments?

Infinity is one of the best alternatives because of transparent lower fees, faster payouts, and India-specific compliance support.

Who should use SWIFT alternatives?

Freelancers, startups, SaaS founders, exporters, and global businesses that receive foreign payments often need to use SWIFT alternatives such as Infinity.

Why use SWIFT alternatives in 2026?

SWIFT alternatives such as Infinity offer faster settlements, lower fees, better FX rates, and simpler compliance than banks.

How fast are SWIFT alternatives?

Most of the SWIFT alternatives in India settle payments within 1–2 business days, which is faster than SWIFT transfers.

Do SWIFT transfers provide FIRA?

Yes, leading SWIFT alternatives issue digital FIRA for compliance and tax purposes.

Do I get FIRA with modern SWIFT alternatives?

Some platforms provide it (like Infinity), while others may charge for it (like Wise) or not offer it (like Stripe).

Are forex rates better than banks?

Yes, SWIFT alternatives in India usually offer transparent, near-market FX rates with lower markups.