Taxation & Compliance

Posted on Jan 28, 2026

Subscribe to our newsletter

Get the latest updates, insights, and tips delivered straight to your inbox.

TL;DR

UTR (Unique Transaction Reference) is the unique tracking code for a bank transfer in India (NEFT/RTGS/IMPS) and is the fastest way to identify a specific transaction.

If a transfer is delayed, not credited, or disputed, sharing the UTR with your bank helps them pull up the exact transfer record and resolve it.

UTR can be found in your bank statement/passbook, internet banking, mobile banking app, or in the SMS/email confirmation received after the transfer.

UTR is the bank’s official reference used to trace the complete payment trail (date, time, amount, sender/receiver bank details) and confirm what actually happened.

What is a UTR Number ?

A UTR (Unique Transaction Reference) is a unique code your bank gives to every transfer in India.

Whenever you send money via NEFT, RTGS, or IMPS, the bank generates a new UTR for that payment.

Being a digital signature, the UTR number helps distinguish one transaction from another, helping both banks and customers to track and verify payments.

UTR Number Example

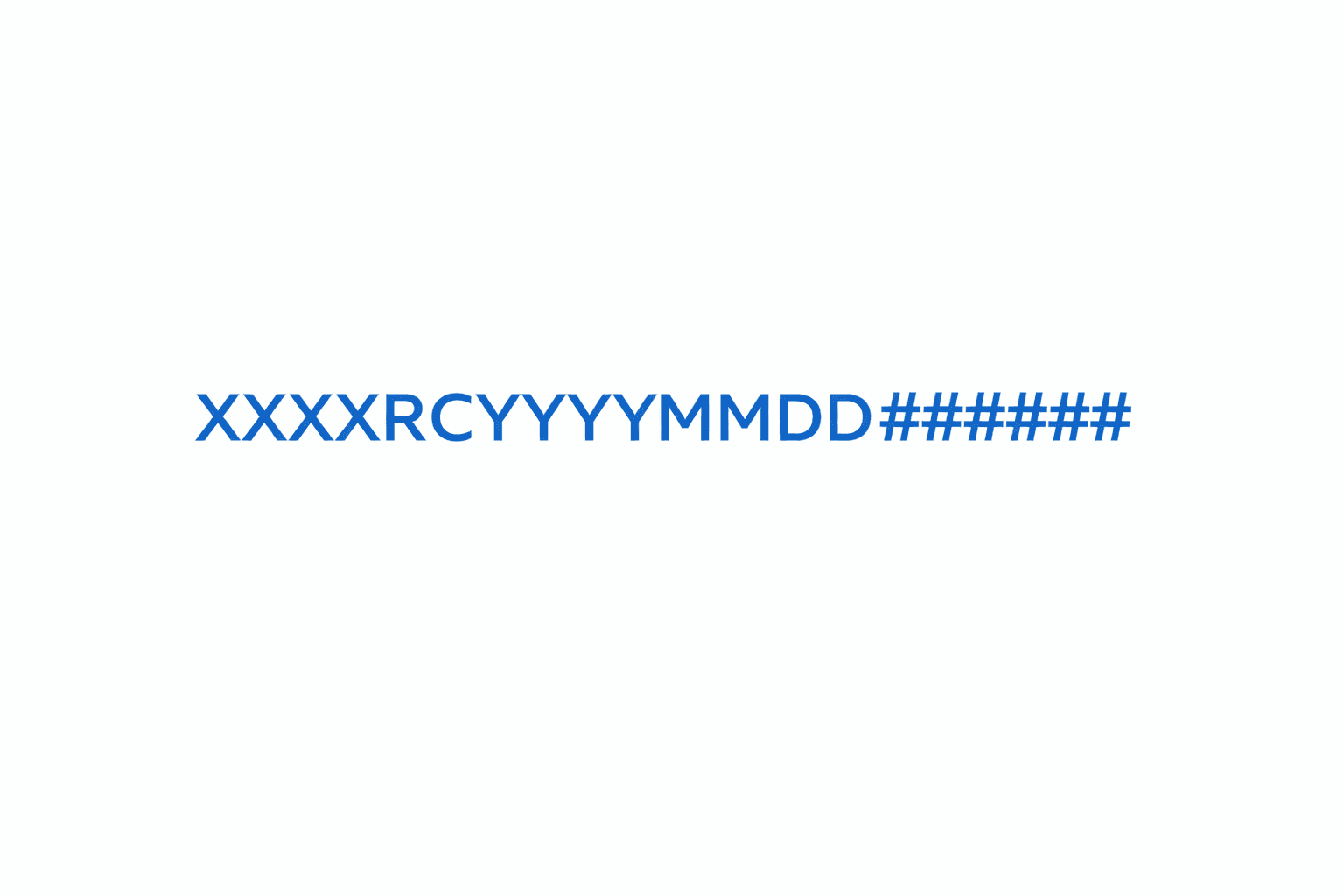

A UTR reference number is automatically generated to uniquely identify that transaction when you transfer funds from one bank account to another.

NEFT transactions use a 16-character UTR number, RTGS transactions usually use a 22-character UTR, and UPI transactions use a 12-digit UTR code.

Where;

XXXX: The first four characters represent the IFSC (Indian Financial System Code) of the sender’s bank.

R: Shows that the transaction was processed through the RTGS system.

C: Indicates that the channel of the transaction (e.g., internet banking, mobile banking).

YYYYMMDD: Gives the year, month, and date of the transaction.

########: A specific sequence number assigned to the transaction.

How To Check UTR Number?

Finding your UTR reference number is simple and can be done using different methods.

Here are the most common ways to check it:

Method 1: Passbooks or Bank Statements

Step 1. Access Your Bank Statement or Passbook

Bank statements can usually be downloaded from your bank’s online portal or by visiting the bank and getting the physical passbook updated.

Step 2. Locate the Transaction

Find the transaction you want to check.

The UTR ID is always mentioned under the transaction details, which include the transaction amount, date, and reference number.

Step 3. Find the UTR Number

Spot the section labeled ‘UTR Number,’ or ‘Unique Transaction Reference,’ or ‘Reference Number,’ in your transaction details.

Method 2: Internet Banking

Step 1. Log In

Log in to your bank’s internet banking portal using your secure credentials.

Step 2. Navigate to Transaction History

Depending on your bank’s interface, open the ‘Transaction History’ or ‘Account Statement’ section.

Step 3. Select the Transaction

Locate the specific transaction you want to track, and click on it to view complete information.

Step 4. View UTR Number

The UTR id will be displayed in the transaction details, find a field labeled ‘UTR,’ or ‘Transaction ID’ or ‘Reference Number.’

Method 3: Mobile Banking Application

Step 1. Open your Banking Application

Log in to your mobile banking application with your secure credentials.

Step 2. Go to the Transaction History

Find the ‘Account Statement’ or ‘Transaction History’ section in the mobile application.

Step 3. Select the Relevant Transaction

Spot and select the transaction you need.

Step 4. Find the UTR Number

Usually, the UTR number would be displayed under the transaction details, usually found labeled as ‘Reference Number’, UTR ID, or ‘UTR.

Method 4: SMS or Transaction Confirmation Email

Step 1. Check your Email or SMS

Check your Email inbox or SMS confirmation of the transaction, the bank usually sends it right after the payment is successful.

Step 2. Locate the UTR Number

Open the message and look under the transaction details; you’ll find the UTR number mentioned there.

Step 3. Get the UTR Number

For tracking or reference purposes, note down or copy the UTR number.

How to Track UTR Number Online?

If you want to track or check your UTR number online, follow these simple steps:

Step 1. Log in to your Bank’s Internet Banking Portal

Go to your bank’s official internet banking website or app.

Sign in using your user ID and password.

Complete all security checks (such as an OTP (One-Time Password) or security questions) if your bank requires them.

Step 2. Go to Transaction History

Look for options like Transaction History, Account Statement, or Transactions.

If you have more than one account, select the account you used to make the transfer.

Step 3. Locate the right Transaction

Use filters like date, amount, or transaction type to quickly spot the transfer.

View Details by clicking on the transaction.

Step 4. Find the UTR Number

In the transaction details, look for ‘UTR Number’, ‘Reference Number’, or ‘Unique Transaction Reference’.

Copy it or note it down as you’ll need it if you’re tracking the payment or raising an issue.

Importance of UTR Numbers

UTR numbers make every bank transfer easy to identify, track, and confirm.

Here are some reasons why they are so important:

Transaction Tracking

A UTR number is a unique ID for every transfer; with this you can easily trace any payment from start to end.

It helps you check the status, confirm that the money moved successfully, and gives you a clear record if you ever need to follow up.

Dispute Resolution

If there’s any mismatch or dispute, the UTR number works as solid proof of the payment.

Both parties can easily use it to pull up transaction details, facilitating faster and more accurate resolution.

Accounting and Taxation

UTR numbers also help you keep your accounts clean and audit-ready.

They are important for reconciling accounts,preparing financial statements, and verifying transactions for tax purposes.

Security and Transparency

Every UTR creates a traceable trail, which adds more transparency and safety to the payment process.

It becomes harder for transactions to get lost or manipulated, and it’s easier for the bank and customer to verify what was sent, when it was sent, and where it went.

Concluding thoughts

Bank transfers can feel stressful when you’re waiting on money and the status isn’t clear. But you don’t have to keep guessing.

A UTR number gives you a reliable way to trace any NEFT/RTGS/IMPS transfer. Just pull up the UTR from your statement or confirmation message, and share it with the bank, and everything becomes easier to track.

And if your payments go beyond local transfers, especially when you’re getting paid by international clients, tracking and timelines can get even more confusing, so you need a platform specifically built for cross-border payments.

That’s where Infinity fits in.

Infinity helps Indian freelancers, startups, and small businesses receive international payments with clarity and control.

You get a seamless experience compared to any traditional wire transfers, with fewer follow-ups, more transparency, and easy tracking.

Plus, it keeps the flow compliance-friendly, so your paperwork doesn’t become a monthly headache.

Ready to simplify your global payments? Try Infinity

Sign Up!

Frequently Asked Questions

What is the full form of UTR in banking?

Unique Transaction Reference is the full form of UTR in banking.

Can the UTR number be used to dispute any transaction?

Yes, your UTR helps the bank trace the exact transfer and is the key reference used while raising a complaint or dispute.

How is a UTR number generated?

UTR is automatically created by the bank when the transaction is processed, usually using details like the bank/channel, date, and a unique sequence to make it one of a kind.

What should I do if I cannot find my UTR number?

If you cannot find your UTR number, check your recent bank statements, passbook, or transaction notifications, and if nothing works out, you can directly contact your bank’s customer service for assistance.

Is UTR and Transaction ID the same?

No, UTR is a specific alphanumeric code used for tracking NEFT, RTGS, and IMPS transactions, while a Transaction ID can refer to a broader range of identifiers used for various payment methods.

What is the UTR number in UPI ?

The UTR number in UPI is typically displayed as the “Transaction ID” or “Reference Number”.

For example, when you make a transaction using UPI, you’ll usually find the UTR number in the transaction details or history section.

How many digits are there in a UPI UTR number?

A UPI UTR (Unique Transaction Reference) number is a 12-digit alphanumeric code.

How many digits are there in a NEFT UTR number?

A NEFT UTR number is a 16-digit alphanumeric code.

How many digits are there in an RTGS UTR number?

A RTGS UTR number consists of 22 alphanumeric characters.